Construction Equipment insurance Rates

Let us shop for the best rate for your construction equipment insurance.

What Is Construction Equipment Insurance?

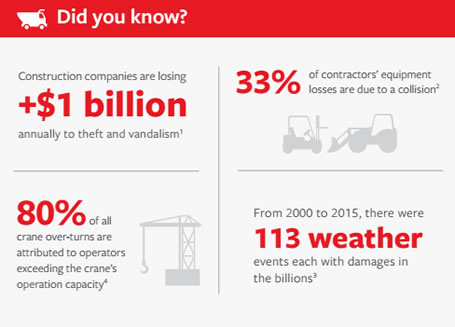

Construction equipment such as bulldozers, cranes and power tools are extremely valuable. Not only is this equipment expensive, but you business simply cannot run without them. In order for these key assets to be protected in the event of damage or loss, construction equipment insurance is an essential part of any construction company’s insurance program.

A construction equipment insurance policy covers exactly what it says: equipment and tools typically used by construction to complete a project. This type of coverage is important not only for contractors, but any business that owns valuable machinery and equipment that moves around. Construction equipment coverage is meant to fill the gaps in commercial property and business auto policies. A business’s personal property can be covered under a commercial property policy, but coverage for property that moves from location to location is typically excluded. A business auto policy also usually excludes coverage for “mobile equipment.”

Purchasing Equipment Insurance

Equipment Insurance Services can help you in selecting the right construction equipment insurance for your business.

Do you have the proper limits scheduled for each piece of equipment?

Your policy will state a specific amount of insurance applicable to each piece of equipment scheduled in the declarations section of your policy. In some cases, you may be able to obtain a blanket limit of coverage, which means you would have one limit that would apply to all of your equipment, rather than a separate limit for each individual piece.

How will your equipment be valued if a loss occurs?

If your policy is written on a replacement cost basis, you will be reimbursed for the cost to “repair or replace” damaged property with “like kind and quality.” The damaged equipment is repaired or replaced with equipment of similar age, condition and quality. If your policy is written on an actual cash value basis, you will be reimbursed for the replacement costs of the property insured at the time of loss minus depreciation. A contractor’s equipment can depreciate quickly, so if you have this policy, you need to be mindful of how your policy is written.

Do you loan, lease or rent equipment to others?

If a situation should arise where you are leasing or loaning a piece of equipment to another contractor at a jobsite, you will want to make sure this coverage is in your Construction Equipment policy.

Do you lease or rent equipment from others?

If so, this coverage is available and should be included in your policy. Take a close look at the limits in your policy. If you lease or rent valuable equipment, it is important to have the necessary limits in order to provide coverage for the most valuable pieces needed to complete a job.

Do you need rental expense coverage?

This could be important coverage to obtain if a piece of owned, leased or rented equipment is damaged and you incur additional expense to replace that piece in order to keep working without interruption.

What Is Covered?

A construction equipment insurance policy from Equipment Insurance Services provides coverage for the direct physical damage/loss to mobile machinery and equipment that is most often used in the construction industry. This coverage follows the equipment when in transit. Among other things, the policy provides the necessary protection against perils such as fire, vandalism, theft and flood. In many cases, it covers equipment that is owned, rented, leased or borrowed.

The equipment that is commonly covered under a Construction Equipment policy includes but is not limited to

- Bulldozers

- Forklifts

- Backhoes

- Excavators

- Cranes

- Diggers

- Pavers

- And More

Construction equipment insurance policies can be written in a variety of ways. To learn more, contact us today!